One of the biggest issues working with aggregator's is reconciling the payments. Different aggregator's use different methods to calculate commissions, they have different payment cycles. Aggregator's are always running offers and schemes which affects your payouts. There is no easy way to match the actual amount that you should receive and that you have received.

With the rapid advancement in technology, more and more food delivery aggregator's are offering their services to people all around India. Here are the names of a few of the most popular food delivery aggregator's in India:

- Zomato

- Swiggy

- Ubereats

- Dunzo

As a restaurant owner, you already would have a clear-cut idea of how these food delivery aggregator's operate. Plus, the chances are that you might already know how hard it is to handle all of the aggregator reports individually and handle the taxation for each of the orders manually. And that’s what exactly we are here to help you with.

Feeling hungry at 4 AM in the night, or craving for some exotic cuisine or just wanted to enjoy a simple meal? All you need to do is to fire up your favorite food delivery app and order what you want to eat. Food delivery in India has been made as simple as ABC. Some of the top startup's in India put their heart and soul in making food delivery easy, cheap, and efficient for the consumers. But what about the restaurants? How do these food delivery aggregator's impact the restaurants out there? Do they benefit as well?

Let’s take a look at what a restaurant owner has to say about these food delivery aggregator's

" Opening a dark kitchen or delivery only outlet has become easier and a less costly affair, but everything after that is a nightmare from managing orders to managing customer expectation, to weekly payout. All of it is a disaster"

Let’s assume that you own an outlet in Mumbai and are currently in business with three food delivery aggregator's under two different names. Managing orders from 6 different listing and menu of 6 different listings is already a nightmare, and as soon as it's the end of the week and it’s time for the weekly payout from the aggregator's. Downloading six different reports from the aggregator's dashboard and matching every order manually, calculating your GST liability, and checking if the aggregator has deducted the commission correctly and no additional fees are charged is next to impossible. Let’s take an example and try to understand this complex problem.

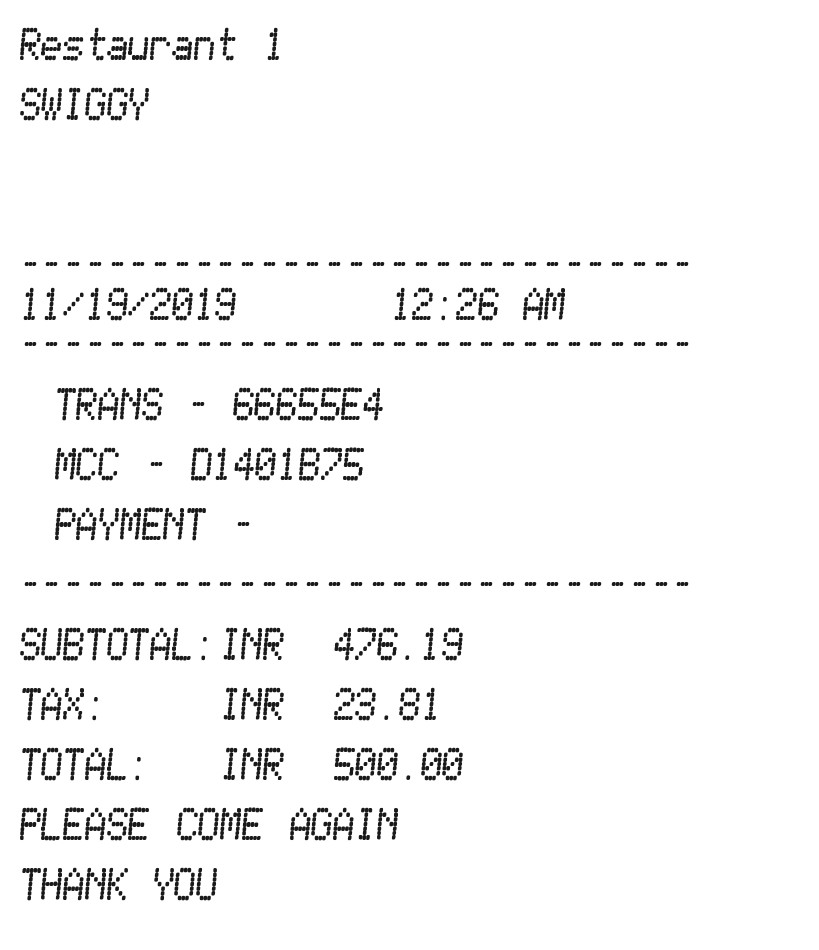

Let’s just say your restaurant receives an order from one of the aggregator's, the total bill value is 500/- and you are running a discount of 30%. The discount of 30% is offered by your restaurant in collaboration with the aggregator, the discount amount is shared equally by restaurant and aggregator.

It requires ten different calculations to find your GST liability. Some of which are Restaurants discount share, commission on the net payable, GST on commission, Customer GST liability, etc. That’s just a single order. Assume calculating this for 500 orders every week. Food delivery aggregator's will generate a weekly aggregator report for each of the outlets that you own. This means that you will receive 2*3= 6 aggregator reports for one outlet that you own.

After receiving all of these reports, you will simply send all of them to your accountant. Your accountant will check each of the orders manually for taxation and will calculate the amount receivable after deducting the commissions, taxes, discounts, and any hidden surcharge by the aggregator's. Calculating taxes for thousands of orders that you receive on a weekly basis isn't merely possible.

Plus, there is a higher probability of manual errors being made. Many times, these food delivery aggregator's even manipulate the data. And the sad thing is, there’s just no way to track such manipulation of data.

Solution

Instead of handling different aggregator accounts, each of the orders from various aggregator's will appear under a single dashboard.

Based on the aggregator's commission, taxes, and growth packs, this feature will carry out all of these calculations automatically and display the variations of each of the orders.

With the BillNote Account Reconciliation feature, you don’t have to handle different accounts for different aggregator's. Your accountant will receive a simple report with GST calculated. And that’s not it.

As we just mentioned above, sometimes, some of these food aggregator's even manipulate data, and there's just no way to track it. So, it’s a LOSE-LOSE situation if you don’t equip the reconciliation feature. Imagine the amount of time and money that you’ll save if you equip the BillNote Link’s reconciliation feature in your arsenal.